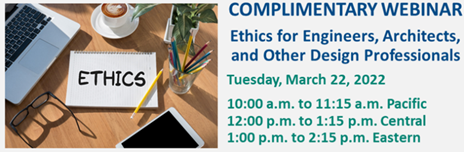

Presented by:

Brian Sutter, ESQ. Managing Partner, Sugarman Law Firm LLP

Stephen Davoli, ESQ. Partner, Sugarman Law Firm LLP

Andrew D. Mendelson, FAIA, Senior Vice President, Chief Risk Management Officer, Berkley Design Professional

Tuesday, March 22, 2022

10:00 am – 11:15 am Pacific Daylight Time

1.25 AIA Learning Units

1.25 RCEP Professional Development Hours

Health Safety and Welfare Qualified

Berkley DP policyholders who participate in this program can qualify for a 15% Risk Management Education credit. Contact your agent for further information*

This webinar has been recorded and is available on demand for Berkley Design Professional policyholders and our appointed agents and brokers on the BDP Risk® Learning Management System.

bdp Risk® lms loginEthical behavior is integral to the practice of architecture and engineering, necessitated by the professional’s duty to protect the health, safety, and welfare of the public. Making decisions and taking action can be complicated by ethical obligations imposed by multiple bodies: professional association codes of conduct, state practice acts, and licensing board requirements. Using professional association codes of conduct as a framework, this workshop offers a four-step process to make sound ethical decisions and explores real-life ethical cases to illustrate the challenges, dilemmas, and consequences of unethical behavior. In addition, participants will take away six key strategies to avoid ethical problems.

Read more »