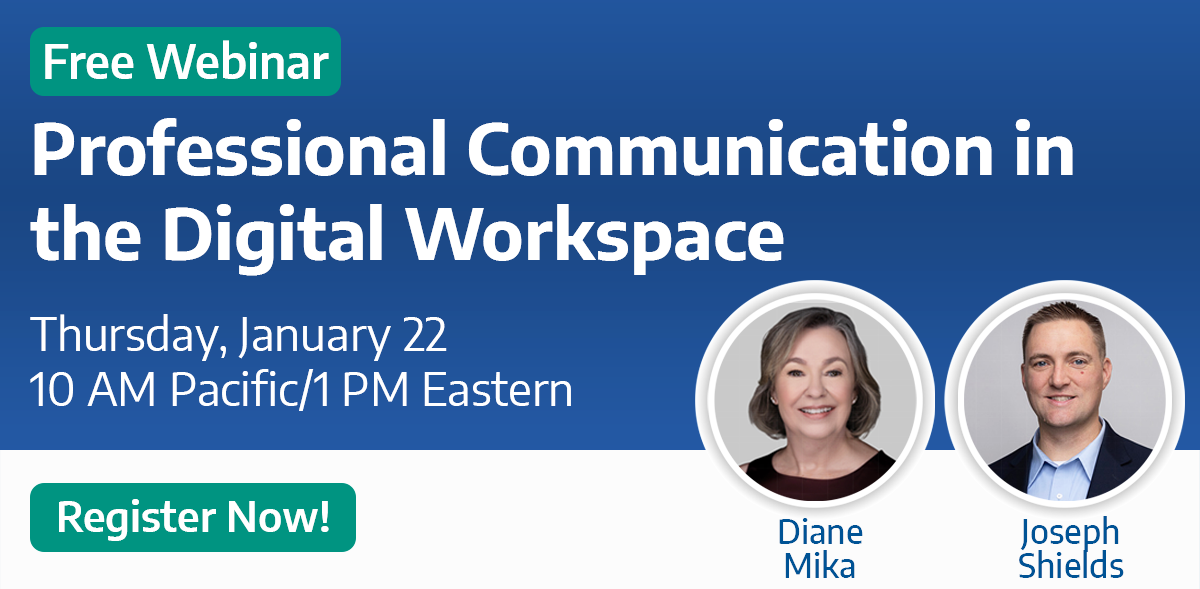

By Diane Mika

Senior Vice President, Risk Management Officer

Berkley Design Professional, a Berkley Company

June 12, 2025

Signed contracts are recommended for every project. In a perfect world, this would be in the form of a professional services agreement that acknowledges the standard of care and complies with your professional liability insurance coverage. To accomplish this outcome, many design firms incorporate their standard terms and conditions into their proposal documents or use their standard agreements or those written by professional associations such as the AIA or EJCDC.

However, it is not unusual for an architect, engineer, or other design professional to be presented with an owner’s purchase order form (PO) or, for engineering or other design services requested by a contractor (including design-build), with a contractor’s construction subcontract. In general, these forms are not appropriate for design or other professional services and should not be used except for limited scope projects. In that event, there are eight clauses you should add to help reduce risk and properly address professional liability exposure including Standard of Care, Schedule, Disclaimer of Construction Responsibility, Document Ownership and Indemnification, Third-Party Exposure, Limitation of Liability and Waiver of Consequential Damages.

In the example language provided in this document, the term “Consultant” is intended to represent the design professional in contract with the “Client.” You should adapt the language to reflect the defined titles of the parties in your agreement.

1. Standard of Care

Purchase Orders and construction subcontracts are intended for use with product vendors and contractors that operate under a warranty standard—they can guarantee their work product. In contrast, architects and engineers perform design services under a professional Standard of Care (SOC) and carry professional liability insurance (PLI) to cover related errors and/or omissions—perfection is not expected. Therefore, you should establish the SOC as an initial clause in a PO or construction subcontract, with an express disclaimer of warranty and fiduciary relationships.

Standard of Care

[DESIGN FIRM NAME] is a consultant providing professional design services on the Project (“Consultant”). Consultant shall perform its services consistent with the professional skill and care ordinarily provided by consultants practicing in the same or similar locality under the same or similar circumstances (“Standard of Care”). Consultant shall perform its services as expeditiously as is consistent with such professional skill and care and the orderly progress of the Project. Notwithstanding any other representations made elsewhere in this Agreement or in the execution of the Project, this Standard of Care shall not be modified. No warrantees or guarantees are expressed or implied under this Agreement or otherwise in connection with Consultant’s services.

Consultant shall act as an independent contractor at all times during the performance of its services, and no term of this Agreement, either expressed or implied, shall create an agency or fiduciary relationship.

2. Schedule

Your schedule of services should be written in the context of the SOC and a mutually agreeable project schedule subject to revision as the project proceeds—not as a “Time is of the Essence” requirement, which would expose your firm to uninsured strict liability as a performance guarantee.

Project Schedule

Consultant shall provide its services in accordance with the project schedule and schedule for performance of Consultant’s design services, which schedules may be modified periodically with the mutual agreement of Client and Consultant and for factors beyond the control of Consultant. In the event Consultant is hindered, delayed, or prevented from performing its obligations under this Agreement as a result of any cause beyond its reasonable control, including but not limited to delays due to power or data system outages, acts of nature, public health emergencies including but not limited to infectious disease outbreaks and pandemics, governmental orders, or directives, failure of any governmental or other regulatory authority to act in a timely manner, failure of Client to furnish timely information or approve or review Consultant’s services or design documents, delays caused by faulty performance by Client’s contractors or consultants, or other unforeseen conditions, the time for completion of Consultant’s services shall be extended by the period of resulting delay and compensation equitably adjusted. Client agrees that Consultant shall not be responsible for damages, nor shall Consultant be deemed in default of this Agreement due to such delays.

Read more »